UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

NexGel, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies:

| |

| (2) | Aggregate number of securities to which transaction applies:

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

| (4) | Proposed maximum aggregate value of transaction:

| |

| (5) | Total fee paid:

| |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid:

| |

| (2) | Form, Schedule or Registration Statement No.:

| |

| (3) | Filing party:

| |

| (4) | Date Filed:

| |

NexGel, Inc.

2150 Cabot Blvd West, Suite B

Langhorne, Pennsylvania 19047

(215) 702-8550

, 2022

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of NexGel, Inc. to be held at 10:00 a.m., Eastern Time, on August 30, 2022, at our corporate headquarters located at 2150 Cabot Blvd West, Suite B, Langhorne, Pennsylvania 19047.

We are distributing our proxy materials to certain stockholders via the Internet under the U.S. Securities and Exchange Commission “Notice and Access” rules. We believe this approach allows us to provide stockholders with a timely and convenient way to receive proxy materials and vote, while lowering the costs of delivery and reducing the environmental impact of our Annual Meeting. We are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) beginning on or about , 2022, rather than a paper copy of the Proxy Statement, the proxy card and our 2021 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2021, as amended. The Notice of Internet Availability contains instructions on how to access the proxy materials, vote and obtain, if desired, a paper copy of the proxy materials.

Your vote is very important, regardless of the number of shares of our voting securities that you own. Whether or not you expect to be present at the Annual Meeting, after receiving the Notice of Internet Availability please vote as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. As an alternative to voting in person at the Annual Meeting, you may vote via the Internet, by telephone, or by signing, dating and returning the proxy card that is mailed to those that request paper copies of the Proxy Statement and the other proxy materials. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the meeting.

On behalf of the Board of Directors, I urge you to submit your vote as soon as possible, even if you currently plan to attend the meeting in person.

Thank you for your support of our company. I look forward to seeing you at the Annual Meeting.

| Sincerely, | |

| /s/ Steven Glassman | |

| Steven Glassman | |

| Chairperson of the Board of Directors |

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON AUGUST 30, 2022:

Our official Notice of Annual Meeting of Stockholders, Proxy Statement, Form of Proxy Card and

2022 Annual Report to Stockholders are available at:

www.proxyvote.com

NEXGEL, INC.

2150 Cabot Blvd West, Suite B

Langhorne, Pennsylvania 19047

(215) 702-8550

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 30, 2022

The 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of NexGel, Inc., a Delaware corporation (the “Company”), will be held on August 30, 2022, at 10:00 a.m. Eastern Time, at our corporate headquarters located at 2150 Cabot Blvd West, Suite B, Langhorne, Pennsylvania 19047. We will consider and act on the following items of business at the Annual Meeting:

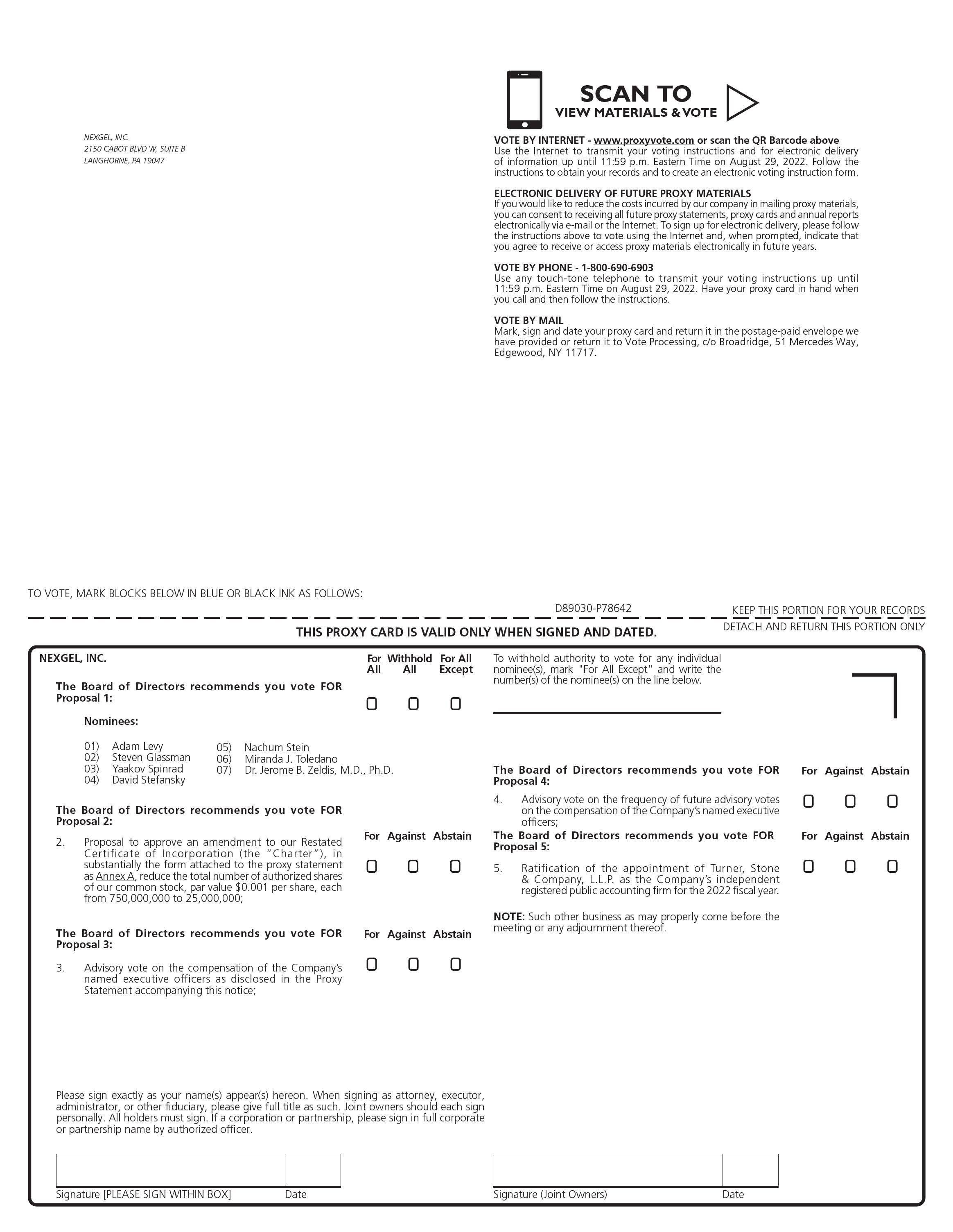

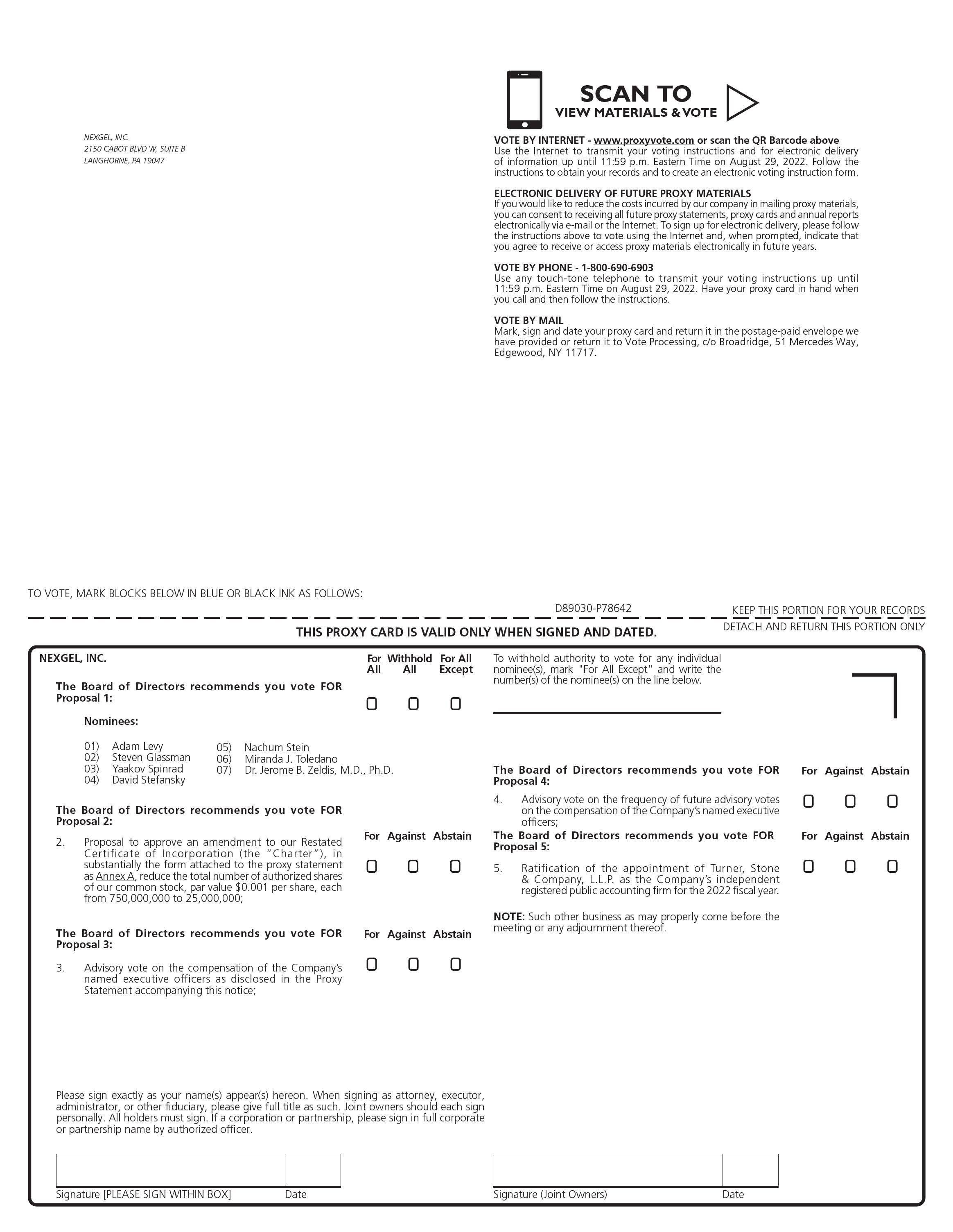

| (1) | Election of seven directors to serve as directors on our Board of Directors to serve until our 2023 Annual Meeting of Stockholders or until successors have been duly elected and qualified. | |

| (2) | A proposal to approve an amendment to our Restated Certificate of Incorporation (the “Charter”), in substantially the form attached to the proxy statement as Annex A, reduce the total number of authorized shares of our common stock, par value $0.001 per share, each from 750,000,000 to 25,000,000. | |

| (3) | An advisory vote on the compensation of the Company’s named executive officers as disclosed in the Proxy Statement accompanying this notice. | |

| (4) | An advisory vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers. | |

| (5) | Ratification of the appointment of Turner, Stone & Company, L.L.P., as our independent registered public accounting firm for the 2022 fiscal year. | |

| (6) | Such other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

Stockholders are referred to the proxy statement accompanying this notice (the “Proxy Statement”) for more detailed information with respect to the matters to be considered at the Annual Meeting. After careful consideration, the Board of Directors recommends a vote “FOR” the election of the nominees as directors (Proposal 1); “FOR” Proposals 2, 3, and 5; and “FOR” holding an advisory vote every three years regarding approval of the compensation of the Company’s named executive officers (Proposal 4).

The Board of Directors has fixed the close of business on July 6, 2022, as the record date (the “Record Date”) for the Annual Meeting. A complete list of registered stockholders entitled to vote at the Annual Meeting will be available for inspection at the office of the Company during regular business hours for the ten (10) calendar days prior to and during the Annual Meeting.

YOUR VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting in person, we request that you vote by telephone, over the Internet, or complete, date, sign and mail the enclosed form of proxy in accordance with the instructions set out in the proxy card and in the Proxy Statement to ensure that your shares will be represented at the Annual Meeting.

If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the Annual Meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting.

| By Order of the Board of Directors, | |

| /s/ Steven Glassman | |

| Steven Glassman | |

| Chairperson of the Board of Directors |

, 2022

TABLE OF CONTENTS

NEXGEL, INC.

2150 Cabot Blvd West, Suite B

Langhorne, Pennsylvania 19047

(215) 702-8550

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held August 30, 2022

Unless the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” “the Company,” or “NexGel” refer to NexGel, Inc., a Delaware corporation, and its consolidated subsidiaries as a whole. In addition, unless the context otherwise requires, references to “stockholders” are to the holders of our common stock, par value $0.001 per share, each of whom is entitled to vote at the 2022 annual meeting of stockholders of the Company (the “Annual Meeting”).

The accompanying proxy is solicited by the Board of Directors (the “Board”) on behalf of NexGel, Inc. to be voted at the Annual Meeting to be held on August 30, 2022, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and at any adjournment(s) or postponement(s) of the Annual Meeting. This Proxy Statement and accompanying form of proxy are dated , 2022 and are expected to be first sent or given to stockholders on or about , 2022.

The executive offices of the Company are located at, and the mailing address of the Company is 2150 Cabot Blvd West, Suite B, Langhorne, Pennsylvania 19047.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON August 30, 2022:

As permitted by the “Notice and Access” rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement, the proxy card and our Annual Report available to stockholders electronically via the Internet at the following website: www.proxyvote.com.

On or about , 2022, we mailed to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how stockholders may access and review all of the proxy materials and how to vote. Also on or about , 2022, we began mailing printed copies of the proxy materials to stockholders that previously requested printed copies. If you received a Notice of Internet Availability by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability.

What is a proxy?

A proxy is another person that you legally designate to vote your stock. If you designate someone as your proxy in a written document, that document is also called a “proxy” or a “proxy card.” If you are a “street name” holder, you must obtain a proxy from your broker or nominee in order to vote your shares in person at the Annual Meeting.

What is a proxy statement?

A proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your stock at the Annual Meeting.

| 1 |

Why did I receive a Notice of Internet Availability of Proxy Materials instead of paper copies of the proxy materials?

We are using the SEC’s Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials over the Internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about , 2022, we began mailing to stockholders a Notice of Internet Availability containing instructions on how to access our proxy materials on the Internet and how to vote online. The Notice of Internet Availability is not a proxy card and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the Notice, which include the following:

| (1) | seven directors to serve as directors on our Board of Directors to serve until our 2023Annual Meeting of Stockholders or until successors have been duly elected and qualified (“Proposal 1”); | |

| (2) | A proposal to approve an amendment to our Restated Certificate of Incorporation (the “Charter”), in substantially the form attached to the proxy statement as Annex A, reduce the total number of authorized shares of our common stock, par value $0.001 per share, each from 750,000,000 to 25,000,000 (“Proposal 2”); | |

| (3) | an advisory vote on the compensation of the Company’s named executive officers as disclosed in the Proxy Statement accompanying this notice (“Proposal 3”); | |

| (4) | an advisory vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers (“Proposal 4”); | |

| (5) | ratification of the appointment of Turner, Stone & Company, L.L.P. as our independent registered public accounting firm for the 2022 fiscal year (“Proposal 5”); and | |

| (6) | such other business as may arise and that may properly be conducted at the Annual Meeting or any adjournment or postponement thereof. |

What should I do if I receive more than one set of voting materials?

You may receive more than one Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, this Proxy Statement and the proxy card) or voting instruction card. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a stockholder of record and hold shares in a brokerage account, you will receive a Notice of Internet Availability (or, if you requested a printed copy of the proxy materials, a proxy card) for shares held in your name and a voting instruction card for shares held in “street name.” Please follow the separate voting instructions that you received for your shares common stock held in each of your different accounts to ensure that all of your shares are voted.

What is the record date and what does it mean?

The record date to determine the stockholders entitled to notice of and to vote at the Annual Meeting is the close of business on July 6, 2022 (the “Record Date”). The Record Date is established by the Board as required by Delaware law. On the Record Date, 5,572,234 shares of common stock were issued and outstanding.

Who is entitled to vote at the Annual Meeting?

Our common stock is the only class of security entitled to vote at our Annual Meeting.

| 2 |

What are the voting rights of the stockholders?

Each holder of common stock is entitled to one vote per share of common stock on all matters to be acted upon at the Annual Meeting.

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of stock entitled to vote at the Annual Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented at the Annual Meeting, then either (i) chairperson of the meeting or (ii) the stockholders entitled to vote thereat, present in person or represented by proxy, may adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum is present or represented.

What is the difference between a stockholder of record and a “street name” holder?

If your shares are registered directly in your name with Continental Stock Transfer & Trust Co., the Company’s stock transfer agent, you are considered the stockholder of record with respect to those shares. The Notice of Internet Availability has been sent directly to you by the Company.

If your shares are held in a stock brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” The Notice of Internet Availability has been forwarded to you by your nominee. As the beneficial owner, you have the right to direct your nominee concerning how to vote your shares by using the voting instructions the nominee included in the mailing or by following such nominee’s instructions for voting.

What is a broker non-vote?

Broker non-votes occur when shares are held indirectly through a broker, bank or other intermediary on behalf of a beneficial owner (referred to as held in “street name”) and the broker submits a proxy but does not vote for a matter because the broker has not received voting instructions from the beneficial owner and (i) the broker does not have discretionary voting authority on the matter or (ii) the broker chooses not to vote on a matter for which it has discretionary voting authority. Under the rules of the Nasdaq Stock Market that govern how brokers may vote shares for which they have not received voting instructions from the beneficial owner, brokers are permitted to exercise discretionary voting authority only on “routine” matters when voting instructions have not been timely received from a beneficial owner. Proposal 5 is considered a “routine matter.” Therefore, if you do not provide voting instructions to your broker regarding such proposal, your broker will be permitted to exercise discretionary voting authority to vote your shares on such proposal. In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to Proposals 1, 3, or 4 but does have discretionary authority to vote your shares with respect to Proposals 2 and 5.

How do I vote my shares?

If you are a record holder, you may vote your shares at the Annual Meeting in person or by proxy. To vote in person, you must attend the Annual Meeting and obtain and submit a ballot. The ballot will be provided at the Annual Meeting. To vote by proxy, you may choose one of the following methods to vote your shares:

| ● | Via Internet: as prompted by the menu found at www.proxyvote.com, follow the instructions to obtain your records and submit an electronic ballot. Please have your Stockholder Control Number, which can be found on the bottom of the Notice of Internet Availability, when you access this voting site. You may vote via the Internet until 11:59 p.m., Eastern Time, on August 29, 2022. |

| ● | Via telephone: call 1-800-690-6903 and then follow the voice instructions. Please have your Stockholder Control Number, which can be found on the bottom of the Notice of Internet Availability, when you call. You may vote by telephone until 11:59 p.m., Eastern Time, on August 29, 2022. |

| 3 |

| ● | Via mail: if you requested printed proxy materials as provided in the Notice of Internet Availability and would like to vote by mail, complete and sign the accompanying proxy card and return it in the postage-paid envelope provided. If you submit a signed proxy without indicating your vote, the person voting the proxy will vote your shares according to the Board’s recommendation. |

The proxy is fairly simple to complete, with specific instructions on the electronic ballot, telephone or card. By completing and submitting it, you will direct the designated persons (known as “proxies”) to vote your stock at the Annual Meeting in accordance with your instructions. The Board has appointed Adam Levy and Adam Drapczuk to serve as the proxies for the Annual Meeting.

Your proxy will be valid only if you complete and return it before the Annual Meeting. If you properly complete and transmit your proxy but do not provide voting instructions with respect to a proposal, then the designated proxies will vote your shares “FOR” each proposal as to which you provide no voting instructions in accordance with the Board’s recommendation in the manner described under “What if I do not specify how I want my shares voted?” below. We do not anticipate that any other matters will come before the Annual Meeting, but if any other matters properly come before the meeting, then the designated proxies will vote your shares in accordance with applicable law and their judgment.

If you hold your shares in “street name,” your bank, broker or other nominee should provide to you a request for voting instructions along with the Company’s proxy solicitation materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you partially complete the voting instruction but fail to complete one or more of the voting instructions, then your nominee may be unable to vote your shares with respect to the proposal as to which you provided no voting instructions. See “What is a broker non-vote?” Alternatively, if you want to vote your shares in person at the Annual Meeting, you must contact your nominee directly in order to obtain a proxy issued to you by your nominee holder. Note that a broker letter that identifies you as a stockholder is not the same as a nominee-issued proxy. If you fail to bring a nominee-issued proxy to the Annual Meeting, you will not be able to vote your nominee-held shares in person at the Annual Meeting.

Who counts the votes?

All votes will be tabulated by a representative of Broadridge Financial Solutions, the inspector of election appointed for the Annual Meeting. Each proposal will be tabulated separately.

Can I vote my shares in person at the Annual Meeting?

Yes. If you are a stockholder of record, you may vote your shares at the meeting by completing a ballot at the Annual Meeting.

If you hold your shares in “street name,” you may vote your shares in person only if you obtain a proxy issued by your bank, broker or other nominee giving you the right to vote the shares.

Even if you currently plan to attend the Annual Meeting, we recommend that you also return your proxy or voting instructions as described above so that your votes will be counted if you later decide not to attend the Annual Meeting or are unable to attend.

What are my choices when voting?

In the election of the nominees as directors (Proposal 1), stockholders may vote for the director nominees or may withhold their votes as to one or more director nominees. With respect to the advisory vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal 4), stockholders may vote to choose an advisory vote on executive compensation every one, two or three years or to abstain from voting on the proposal. With respect to the approval of the amendment to the Charter to reduce the number of authorized shares of common stock (Proposal 2), the advisory vote on executive compensation (Proposal 3) and the ratification of the independent registered public accounting firm (Proposal 5), stockholders may vote for the proposal, against the proposal, or abstain from voting on the proposal.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

Proposal 1—FOR the election of the nominees as directors.

Proposal 2—FOR approval of the amendment to the Charter to reduce the number of authorized shares of common stock.

| 4 |

Proposal 3—FOR the approval of the executive compensation as disclosed in these materials.

Proposal 4—FOR an advisory vote on executive compensation every three years.

Proposal 5—FOR the ratification of the appointment of the independent registered public accounting firm.

What if I do not specify how I want my shares voted?

If you are a record holder who returns a completed proxy that does not specify how you want to vote your shares on one or more proposals, the proxies will vote your shares for each proposal as to which you provide no voting instructions, and such shares will be voted in the following manner:

Proposal 1—FOR the election of the nominees as directors.

Proposal 2—FOR the approval of the amendment to the Charter to reduce the number of authorized shares of common stock.

Proposal 3—FOR the approval of the executive compensation as disclosed in these materials.

Proposal 4—FOR an advisory vote on executive compensation every three years.

Proposal 5—FOR the ratification of the appointment of the independent registered public accounting firm.

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee may be unable to vote those shares. See “What is a broker non-vote?” above.

Can I change my vote?

Yes. If you are a record holder, you may revoke your proxy at any time by any of the following means:

| ● | Attending the Annual Meeting and voting in person. Your attendance at the Annual Meeting will not by itself revoke a proxy. You must vote your shares by ballot at the Annual Meeting to revoke your proxy. | |

| ● | Completing and submitting a new valid proxy bearing a later date. | |

| ● | Giving written notice of revocation to the Company addressed to Adam Drapczuk, Chief Financial Officer, at the Company’s address above, which notice must be received before 5:00 p.m., Eastern Time, on August 29, 2022. |

If you are a “street name” holder, your bank, broker or other nominee should provide instructions explaining how you may change or revoke your voting instructions.

What votes are required to approve each proposal?

Assuming the presence of a quorum, with respect to Proposal 1, the affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election of the director nominees, i.e., the seven director nominees who receive the most votes will be elected.

Assuming the presence of a quorum, approval of Proposal 2 and will require the affirmative vote of a majority of the number of votes entitled to voter for or against the proposal.

Assuming the presence of a quorum, the approval of the executive compensation (Proposal 3), and the ratification of the independent registered public accounting firm (Proposal 5) will require the affirmative vote of the holders of a majority of the shares of our voting securities represented in person or by proxy at the Annual Meeting entitled to vote on such proposal that voted for or against such proposal. For the advisory vote on how frequently our stockholders should vote on the compensation of our named executive officers in (Proposal 4), the number of years (1, 2 or 3) that receives the highest number of votes will be deemed to be preferred by our stockholders. Please note that the vote on executive compensation (Proposal 3) and the vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal 4) are non-binding advisory votes.

| 5 |

How are abstentions and broker non-votes treated?

Abstentions are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting. Abstentions will have no effect with respect to the election of the nominees as directors (Proposal 1), the advisory vote on executive compensation (Proposal 3), the advisory vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal 4) or the ratification of the independent registered public accounting firm (Proposal 5). Abstentions will have the same effect as a vote against the proposal to approve the amendment to the Charter to reduce the number of authorized shares of common stock (Proposal 2).

Broker non-votes are included in the determination of the number of shares present at the Annual Meeting for determining a quorum at the meeting. Broker non-votes will have no effect upon the election of the nominees as directors (Proposal 1), the advisory vote on executive compensation (Proposal 3), and the advisory vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal 4). With respect to the proposal to approve the amendment to the Charter to reduce the number of authorized shares of common stock (Proposal 2) and the proposal to ratify the appointment of the independent registered public accounting firm (Proposal 5), broker-non-votes are not applicable because such proposal is considered a routine matter and therefore a broker holding shares for a beneficial owner will have discretionary authority to vote those shares for such proposal in the absence of voting instructions from the beneficial owner.

Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our stockholders has any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

Our Board is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of common stock and collecting voting instructions. We may use officers and employees of the Company to ask for proxies, as described below.

Is this Proxy Statement the only way that proxies are being solicited?

No. In addition to the solicitation of proxies by use of the Notice of Internet Availability, officers and employees of the Company may solicit the return of proxies, either by mail, telephone, telecopy, e-mail or through personal contact. These officers and employees will not receive additional compensation for their efforts but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees and fiduciaries, in connection with shares of the common stock registered in their names, will be requested to forward solicitation material to the beneficial owners of shares of common stock.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the Notice and has no information that others will do so. If other matters requiring a vote of the stockholders properly come before the Annual Meeting, it is the intention of the persons named in the form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find voting results?

We expect to publish the voting results in a current report on Form 8-K, which we expect to file with the SEC within four business days after the Annual Meeting.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have any questions, or need additional materials, please feel free to contact our Chief Financial Officer, Adam Drapczuk, at (215) 702-8550.

| 6 |

PROPOSAL 1: ELECTION OF DIRECTORS

The Board currently is comprised of seven directors. Our Board, upon the recommendation of the Nominating and Corporate Governance Committee, has nominated the following seven individuals to serve as directors (collectively, the “Company Nominees”):

| Name | Age | |||

| Adam Levy | 59 | |||

| Steven Glassman | 57 | |||

| Yaakov Spinrad | 32 | |||

| David Stefansky | 50 | |||

| Nachum Stein | 73 | |||

| Miranda J. Toledano | 45 | |||

| Dr. Jerome B. Zeldis, M.D., Ph.D. | 72 | |||

If elected, respectively, these nominees will serve until our 2023 Annual Meeting of Stockholders or until successors have been duly elected and qualified. Our board of directors believes that all of our current directors, including the seven nominees for election, possess personal and professional integrity, good judgment, a high level of ability and business acumen.

If a quorum is present, the Company Nominees will be elected by a plurality of the votes cast at the Annual Meeting. Abstentions and broker non-votes have no effect on the vote. The seven Company Nominees receiving the highest number of affirmative votes will be elected directors of the Company. Shares of voting stock represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named below. Should any Company Nominee become unable or unwilling to accept nomination or election, the proxy holders may vote the proxies for the election, in his or her stead, of any other person the Board may nominate or designate. Each Company Nominee has agreed to serve, if elected, and the Board has no reason to believe that any Company Nominee will be unable to serve.

The Board and the Nominating and Corporate Governance Committee continue to frequently evaluate the optimal size and composition of the Board to allow it to operate nimbly and efficiently, while maintaining new ideas, expertise, experience and diversity among its membership. As of July 7, 2022, a female comprises approximately 14% of our Board. We currently have no underrepresented minorities on our Board.

| Board Diversity Matrix (as of July 7, 2022) | ||||

| Total Number of Directors | 7 | |||

| Female | Male | |||

| Part I: Gender Identity | 1 | 6 | ||

| Part II: Demographic Background | ||||

| White | 1 | 6 | ||

The biographies of the Company Nominees are as follows:

Adam Levy. Mr. Levy has served as our Chief Executive Officer and President since September 10, 2019 and was our Chief Financial Officer from December 31, 2019 until June 1, 2021. Mr. Levy has also served on our Board since September 9, 2021. Mr. Levy is an investment banker associated with Cova Capital and has been a capital markets specialist for the past six years. Prior to that, he was the president and CEO of Warlock Records Inc. and its related companies from its inception in 1985. While at Warlock, he led the successful turn-around of several financially distressed music companies as part of a roll up strategy. He has expertise in consumer products, marketing, television/radio advertising and direct to consumer sales.

Steven Glassman. Steven Glassman has served on our Board of Director since March 8, 2021. He is currently the Chief Operating Officer for Nephila Advisors, LLC, a Nashville, TN based firm focused on catastrophic reinsurance and weather risk transfer markets in connection with the capital markets. From January 2018 until now, Mr. Glassman focused on Global Business Initiatives at Nephila. From 2010 to 2017, Mr. Glassman served as the Chief Management Officer of Nephila Capital Ltd. Prior to joining Nephila, Mr. Glassman worked at Merrill Lynch in New York in their real estate principal investment group from 1986 to 2009. Mr. Glassman holds a Bachelor of Arts in Economics from Vanderbilt University.

Yaakov Spinrad, Director. Mr. Spinrad has served on our Board of Directors since September 9, 2021. Mr. Spinrad is currently a Venture Partner at Cane Investment Partners, a private investment firm located in Chicago, Illinois. Mr. Spinrad also serves as Chief Executive Officer of Vitae Health Systems, a multi-specialty healthcare solutions private company headquartered in Chicago, Illinois. Mr. Spinrad currently serves on the Board of Directors of Key Autism Services, Third Eye Health, Vitae Health Systems, Relief Mental Health and Hampton Social, all of which are private companies. Prior to Cane Investment Partners’ founding, he worked at a single-family office, where he was both the director of acquisitions, and responsible for numerous portfolio operating companies, and real estate investments.

David Stefansky, Director. Mr. Stefansky has served on our Board of Directors since September 10, 2019. Mr. Stefansky is a principal at Bezalel Partners, LLC, a private company engaged in principal investments and advisory services for early stage companies. He previously served in senior roles at investment banks and in executive and corporate director roles for private and publicly traded companies.

| 7 |

Nachum Stein, Director. Mr. Stein has served on our Board of Directors since September 10, 2019. Mr. Stein is managing partner of HSI Partnership, an industrial and real estate investment family partnership. Mr. Stein previously served as Co-Chairperson of the Board of Directors of Coleman Cable Co., a publicly traded company until its sale in 2014 for more than $700 million. In 1987, he founded American European Group, a private insurance holding company (“AEG”). Mr. Stein is Chairperson and Chief Executive Officer of AEG. Mr. Stein and his family currently own a majority of AEG. Mr. Stein is a former Chairperson of the Board of Directors of Beth Jacob of Boro Park, the largest Jewish Community School for girls in the United States, and also a former member of the Board of Directors of Machon Bais Yakov Hilda Birn High School, and a member of the Board of Trustees of Agudath Israel of America as well as active in various community philanthropies, and committees of Jewish institutions of higher studies.

Miranda J. Toledano, Director. Ms. Toledano has served on our Board of Directors since September 9, 2021. Since May 2022, she has served as the Chief Business Officer, Chief Financial Officer and Head of Corporate Strategy of Entera Bio Ltd. (Nasdaq: ENTX), where she has also served as member of the board of directors since September 2018. Since its founding in 2018, Ms. Toledano served as Chief Operating Officer, Chief Financial Officer and Director at TRIGR Therapeutics, a private clinical stage immuno-oncology company focused on bispecific antibodies which was acquired by Compass Therapeutics in June 2021. Ms. Toledano currently serves as a director of Compass Therapeutics (Nasdaq: CMPX), Journey Medical (Nasdaq: DERM) and Lipomedix, a private company located in Israel. Additionally, Ms. Toledano served on the executive management team of Sorrento Therapeutics (Nasdaq: SRNE) as EVP Corporate Development from September 2016 until August 2017. From 2012 to 2016, Ms. Toledano served as Head of Healthcare Investment Banking at MLV & Co. (acquired by B. Riley FBR & Co.), where she completed equity capital market transactions totaling over $4 billion in aggregate value. Prior to joining MLV, from 2004 until 2010, Ms. Toledano served in the investment group of Royalty Pharma (Nasdaq: RPRX). From 1998 to 2003, Ms. Toledano led the Life Sciences Corporate Finance group at Ernst & Young (Israel). Ms. Toledano holds a BA in Economics from Tufts University and an MBA in Finance and Entrepreneurship from the NYU Stern School of Business.

Dr. Jerome B. Zeldis, M.D., Ph.D., Director. Dr. Zeldis has served on our Board of Directors since April 1, 2020. Since April 2020, Dr. Zeldis has been serving as the executive chairperson ViralClear Pharmaceuticals, Inc., a partially owned subsidiary of BioSig Technologies, Inc. (NASDAQ: BSGM), a company for which Dr. Zeldis has also been a member of the Board of Directors since May 2019. From 2016 to March 2019, Dr. Zeldis served as Chief Medical Officer and President of Clinical Research, Medical Affairs Drug Safety, Quality, and Regulatory at Sorrento Therapeutics, Inc. From 2014 until 2016, Dr. Zeldis served as chief executive officer of Celgene Global Health and chief medical officer of Celgene Corporation. Since June 2011, Dr. Zeldis has been a director of Soligenix, Inc. and PTC Therapeutics, Inc. He attended Brown University for an AB, MS, followed by Yale University for an MPhil, MD, and PhD in Molecular Biophysics and Biochemistry. Dr. Zeldis trained in Internal Medicine at the UCLA Center for the Health Sciences and in Gastroenterology at the Massachusetts General Hospital and Harvard Medical School. He was Assistant Professor of Medicine at the Harvard Medical School, Associate Professor of Medicine at University of California, Davis, Clinical Associate Professor of Medicine at Cornell Medical School and Professor of Clinical Medicine at the Robert Wood Johnson Medical School in New Brunswick, New Jersey.

Family Relationships

There are no family relationships among any of NexGel’s directors or executive officers except that Mr. Stefansky is the uncle of Mr. Spinrad.

Required Vote and Board Recommendation

If a quorum is present and voting, the seven Company Nominees receiving the highest number of votes will be elected as directors. If you hold your shares in your own name and abstain from voting on the election of directors, your abstention will have no effect on the vote. If you hold your shares through a broker and you do not instruct the broker on how to vote for the seven Company Nominees, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the vote.

| The Board recommends that you vote “FOR” each Company Nominee. |

| 8 |

NexGel, with the oversight of the Board and its committees, operates within a comprehensive plan of corporate governance for the purpose of defining independence, assigning responsibilities, setting high standards of professional and personal conduct and assuring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our officers, directors and employees, including our principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics addresses, among other things, conflicts of interest, protection and proper use of Company assets, government relations, compliance with laws, rules and regulations and the process for reporting violations of the Code of Business Conduct and Ethics, improper conflicts of interest or other violations. Our Code of Business Conduct and Ethics is available on our website at www.NexGeltech.com in the “Governance Documents” section found under the “Investors” tab. We intend to disclose any future amendments to certain provisions of the Code of Business Conduct and Ethics, or waivers of such provisions granted to executive officers and directors, on this website within four business days following the date of any such amendment or waiver.

Our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws (“Bylaws”) provide that our Board will consist of one or more members, such number of directors to be determined from time to time pursuant to a resolution adopted by a majority of the total number of authorized directors. Vacancies or newly created directorships resulting from an increase in the authorized number of directors elected by all of the stockholders having the right to vote as a single class may be filled by a majority of the directors then in office, although less than a quorum, or by a sole remaining director.

We have no formal policy regarding Board diversity. Our Board believes that each director should have a basic understanding of the principal operational and financial objectives and plans and strategies of the Company, our results of operations and financial condition and relative standing in relation to our competitors. We take into consideration the overall composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience, knowledge, abilities and customer relationships. Generally, we will strive to assemble a Board that brings to us a variety of perspectives and skills derived from business and professional experience as we may deem are in our and our stockholders’ best interests. In doing so, we will also consider candidates with appropriate non-business backgrounds.

We are currently listed on the NASDAQ Capital Market and therefore rely on the definition of independence set forth in the NASDAQ Listing Rules (“NASDAQ Rules”). Under the NASDAQ Rules, a director will only qualify as an “independent director” if, in the opinion of our Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Based upon information requested from and provided by each director concerning his background, employment, and affiliations, including family relationships, we have determined that each of Steven Glassman, Yaakov Spinrad, Miranda J. Toledano and Dr. Jerome B. Zeldis has no material relationships with us that would interfere with the exercise of independent judgment and is an “independent director” as that term is defined in the NASDAQ Listing Rules.

Board Committees, Meetings and Attendance

During 2021, the Board held seven meetings. We expect our directors to attend Board meetings, meetings of any committees and subcommittees on which they serve and each annual meeting of stockholders. During 2021, we had no incumbent director who attended fewer than 75% of the total number of meetings held by the Board and Board committees of which such director was a member.

We encourage our Board members to attend the annual meeting. This will be our first ever annual meeting.

The Board delegates various responsibilities and authority to different Board committees. Committees regularly report on their activities and actions to the full Board. Currently, the Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Committee assignments are re-evaluated annually. Each of these committees operates under a charter that has been approved by our Board.

| 9 |

As of , 2022, the following table sets forth the membership of each of the Board committees listed above.

| Name | Audit Committee | Compensation Committee | Nominating

and Corporate Governance Committee | |||

| Adam Levy | ||||||

| Steven Glassman* | Member | Chairperson | ||||

| Yaakov Spinrad | Member | Member | ||||

| David Stefansky | ||||||

| Nachum Stein | ||||||

| Miranda J. Toledano | Chairperson | Member | ||||

| Dr. Jerome B. Zeldis, M.D., Ph.D. | Member | Member | Chairperson |

| * | Chairperson of the Board of Directors |

Audit Committee

Our audit committee is currently comprised of Mr. Glassman, Ms. Toledano and Mr. Zeldis, each of whom our board has determined is financially literate and qualifies as an independent director under Section 5605(a)(2) and Section 5605(c)(2) of the Nasdaq rules. Ms. Toledano is the chairperson of our audit committee and Ms. Toledano qualifies as an audit committee financial expert, as defined in Item 407(d)(5)(ii) of Regulation S-K.

Our audit committee has adopted a written audit committee charter, viewable at https://nexgel.com/corporategovernance, that provides that the functions of our audit committee include, among other things:

| ● | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; | |

| ● | helping to ensure the independence and performance of the independent registered public accounting firm; | |

| ● | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; | |

| ● | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; | |

| ● | reviewing our policies on risk assessment and risk management; | |

| ● | reviewing and approving related party transactions; | |

| ● | obtaining and reviewing a report by the independent registered public accounting firm, at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and | |

| ● | approving (or, as permitted, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

Compensation Committee

Our compensation committee is currently comprised of Mr. Glassman, Mr. Spinrad and Mr. Zeldis. Our board has determined that each of Mr. Glassman, Mr. Spinrad and Mr. Zeldis qualifies as an independent director under Section 5605(a)(2) of the Nasdaq rules and a “non-employee director” for purposes of Section 16b-3 under the Exchange Act and does not have a material relationship with us that would affect his ability to be independent from management in connection with the duties of a compensation committee member, as described in Section 5605(d)(2) of the Nasdaq rules. Mr. Glassman is the chairperson of our compensation committee.

Our compensation committee has adopted a written compensation committee charter, viewable at https://nexgel.com/corporategovernance, that provides that the functions of our compensation committee include, among other things:

| ● | reviewing and approving, or recommending to our board of directors for approval, the compensation of our executive officers and any compensatory arrangement with our executive officers; | |

| ● | reviewing and recommending to our board of directors for approval the compensation of our directors and any changes to their compensation; | |

| ● | reviewing and approving, or recommending to our board of directors for approval, and administering incentive compensation and equity incentive plans; and | |

| ● | reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. |

| 10 |

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is currently comprised of Mr. Spinrad, Ms. Toledano and Mr. Zeldis. Our board has determined that each of Mr. Spinrad, Ms. Toledano and Mr. Zeldis qualifies as an independent director under Section 5605(a)(2) of the Nasdaq rules. Mr. Zeldis is the chairperson of our nominating and corporate governance committee.

Our nominating and corporate governance committee has adopted a written nominating and corporate governance committee charter, viewable at https://nexgel.com/corporategovernance, that provides that the functions of our nominating and corporate governance committee include, among other things:

| ● | identifying, evaluating and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors and its committees; | |

| ● | overseeing the evaluation and the performance of our board of directors and of individual directors; | |

| ● | considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees; | |

| ● | overseeing our corporate governance practices; | |

| ● | contributing to succession planning; and | |

| ● | developing and making recommendations to our board of directors regarding corporate governance guidelines and matters. |

Our Nominating and Corporate Governance Committee considers all qualified candidates identified by members of the Board, by senior management and by stockholders. The Nominating and Corporate Governance Committee follows the same process and uses the same criteria for evaluating candidates proposed by stockholders, members of the Board and members of senior management. We did not pay fees to any third party to assist in the process of identifying or evaluating director candidates during 2021 nor during 2022 thus far.

Our Bylaws contain provisions that address the process by which a stockholder may nominate an individual to stand for election to the Board at our Annual Meeting. To recommend a nominee for election to the Board, a stockholder must submit his or her recommendation to our Secretary at our corporate offices at 2150 Cabot Blvd West, Suite B, Langhorne, Pennsylvania 19047. Such nomination must satisfy the notice, information and consent requirements set forth in our Bylaws and must be received by us prior to the date set forth under “Stockholder Proposals” below. A stockholder’s recommendation must be accompanied by the information with respect to stockholder nominees as specified in our Bylaws, including among other things, the name, age, address and occupation of the recommended person, the proposing stockholder’s name and address, the ownership interests of the proposing stockholder and any beneficial owner on whose behalf the nomination is being made (including the number of shares beneficially owned, any hedging, derivative, short or other economic interests and any rights to vote any shares) and any material monetary or other relationships between the recommended person and the proposing stockholder and/or the beneficial owners, if any, on whose behalf the nomination is being made.

In evaluating director nominees, the Nominating and Corporate Governance Committee considers the following factors:

| ● | the appropriate size and diversity of our Board; | |

| ● | our needs with respect to the particular knowledge, skills and experience of nominees, including experience in corporate finance, technology, business, administration and sales, in light of the prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; | |

| ● | experience with accounting rules and practices, and whether such a person qualifies as an “audit committee financial expert” pursuant to SEC rules; and | |

| ● | balancing continuity of our Board with periodic injection of fresh perspectives provided by new Board members. |

Our Board believes that each director should have a basic understanding of our principal operational and financial objectives and plans and strategies, our results of operations and financial condition and our relative standing in relation to our competitors.

| 11 |

In identifying director nominees, the Board will first evaluate the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service will be considered for re-nomination.

If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Board will identify another nominee with the desired skills and experience described above. The Board takes into consideration the overall composition and diversity of the Board and areas of expertise that director nominees may be able to offer, including business experience, knowledge, abilities and customer relationships. Generally, the Board will strive to assemble a Board that brings to us a variety of perspectives and skills derived from business and professional experience as it may deem are in our and our stockholders’ best interests. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

The Board welcomes communication from our stockholders. Stockholders and other interested parties who wish to communicate with a member or members of our Board or a committee thereof may do so by addressing correspondence to the Board member, members or committee, c/o Secretary, NexGel, Inc., 2150 Cabot Blvd West, Suite B, Langhorne, Pennsylvania 19047. Our Secretary will review and forward correspondence to the appropriate person or persons.

All communications received as set forth in the preceding paragraph will be opened by our Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service or patently offensive material will be forwarded promptly to the addressee(s). In the case of communications to the Board or any group or committee of directors, our Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to whom the communication is addressed. If the amount of correspondence received through the foregoing process becomes excessive, our Board may consider approving a process for review, organization and screening of the correspondence by our Secretary or another appropriate person.

Involvement in Certain Legal Proceedings

There have been no material legal proceedings that would require disclosure under the federal securities laws that are material to an evaluation of the ability or integrity of our directors or executive officers, or in which any director, officer, nominee or principal stockholder, or any affiliate thereof, is a party adverse to us or has a material interest adverse to us.

| 12 |

During the period of December 31, 2021, non-employee members of our board of directors were compensated as follows:

| Name | Fees

earned or paid in cash | Stock

Award | Option Awards | Non-equity Incentive Plan Compensation | Nonqualified Deferred Compensation Earnings | All

other Compensation | Total | |||||||||||||||||||||

| Steve Glassman(1) | $ | — | $ | — | $ | 37,818 | $ | — | $ | — | $ | — | $ | 37,818 | ||||||||||||||

| Yaakov Spinrad(3) | $ | — | $ | — | $ | 72,961 | $ | — | $ | — | $ | — | $ | 72,961 | ||||||||||||||

| David Stefansky | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||

| Nachum Stein | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||

| Miranda J Toledano(3) | $ | — | $ | — | $ | 72,961 | $ | — | $ | — | $ | — | $ | 72,961 | ||||||||||||||

| Dr. Jerome B. Zeldis(2) | $ | — | $ | — | $ | 50,424 | $ | — | $ | — | $ | — | $ | 50,424 | ||||||||||||||

(1) On March 8, 2021, the Company appointed Steven Glassman to the Board of Directors to serve for a term expiring at the next annual meeting of stockholders or until his successor is duly elected and qualified. On March 8, 2021 and in consideration for his appointment to the board of directors, the Company granted Mr. Glassman an option to purchase up to 14,286 shares of common stock at a per share exercise price of $2.80 under the Company’s 2019 Long-Term Incentive Plan. This option award fully vested as of the date of grant.

(2) On March 8, 2021, the Company granted Dr. Jerome Zeldis, a member of the Company Board, an option to purchase up to 19,050 shares of the Company’s common stock at a per share exercise price of $2.10 under the Company’s 2019 Long-Term Incentive Plan. This option award fully vested as of the date of grant.

(3) On September 2, 2021, the Company appointed Yaakov Spinrad and Miranda J. Toledano to the Board of Directors to serve for a term expiring at the next annual meeting of stockholders or until his successor is duly elected and qualified. On September 9, 2021 and in consideration for each person’s appointment to the board of directors, the Company granted each of Mr. Spinrad and Ms. Toledano an option to purchase up to 14,286 shares of common stock at a per share exercise price of $5.25 under the Company’s 2019 Long-Term Incentive Plan. This option award vests in four equal calendar quarter installments beginning on October 1, 2021.

Equity Compensation

For fiscal 2022, we have not yet determined the compensation level for our non-employee members of the Board of Directors.

Indemnification of Directors and Officers

Our Certificate of Incorporation allows us to indemnify our present and former officers and directors and other personnel against liabilities and expenses arising from their service to the full extent permitted by Delaware law. The persons indemnified include our (i) present or former directors or officers, (ii) any person who while serving in any of the capacities referred to in clause (i) who served at our request as a director, officer, partner, proprietor, trustee, employee, agent or similar functionary of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan or other enterprise, and (iii) any person nominated or designated by (or pursuant to authority granted by) our Board of Directors or any committee thereof to serve in any of the capacities referred to in clauses (i) or (ii).

| 13 |

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information about beneficial ownership of our common stock as of July 6, 2022, (unless otherwise noted) by (i) each stockholder that has indicated in public filings that the stockholder beneficially owns more than five percent of the common stock, (ii) each of the Company’s directors and named officers and (iii) all directors and officers as a group. Except as otherwise noted, each person listed below, either alone or together with members of the person’s family sharing the same household, had, to our knowledge, sole voting and investment power with respect to the shares listed next to the person’s name.

| Name and address(1) | Number

of shares beneficially owned | Percentage of ownership (2) | ||||||

| 5% stockholders | ||||||||

| None | - | - | ||||||

| Directors and officers | ||||||||

| Steven Glassman | 129,378 | (3) | 2.32 | % | ||||

| Yaakov Spinrad | 14,286 | (4) | * | |||||

| David Stefansky (5) | 291,472 | (6) | 5.14 | % | ||||

| Nachum Stein | 586,504 | (7) | 10.33 | % | ||||

| Miranda J. Toledano | 3,572 | (8) | * | |||||

| Dr. Jerome Zeldis | 116,600 | (9) | 2.08 | % | ||||

| Adam Levy | 309,694 | (10) | 5.54 | % | ||||

| Adam E. Drapczuk | 20,000 | * | ||||||

| (All Directors and officers as a group 8 persons) | 1,484,039 | (11) | 25.31 | % | ||||

* Less than 1%.

| (1) | Except as indicated, the address of the person named in the table is c/o NexGel, Inc., 2150 Cabot Boulevard West, Suite B, Langhorne, PA 19667. |

| (2) | In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of the common stock subject to options or warrants held by that person that are currently exercisable or will become exercisable within 60 days after July 6, 2022, are deemed outstanding, while the shares are not deemed outstanding for purposes of computing percentage ownership of any other person. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of the common stock held by them. Applicable percentage ownership is based on 5,572,234 shares of the common stock outstanding as of July 6, 2022. The inclusion in the table above of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares. |

| (3) | Consists of (i) 115,092 shares of common stock and (ii) options to purchase 14,286 shares of common stock which are currently exercisable. |

| (4) | Consists entirely of options that are either exercisable or will become exercisable within 60 days of July 6, 2022. |

| (5) | Mr. Stefansky is the spouse of Esther Friedman, who owns 178,572 shares of the Company’s common stock. Ms. Stefansky disclaims beneficial ownership of all shares held by Ms. Friedman. |

| (6) | Consists of (i) 12,219 shares of common stock, (ii) 178,572 shares of common stock held through Bezalel Partners LLC, which is solely owned and managed by Mr. Stefansky and (iii) options to purchase 100,681 shares of common stock that are currently exercisable. |

| (7) | Consists of (i) 481,358 shares of common stock and (ii) options or warrants to purchase 105,146 shares of common stock that are currently exercisable. |

| (8) | Consists of (i) 1,819 shares of common stock and (ii) options to purchase 14,286 that are either exercisable or will become exercisable within 60 days of July 6, 2022. |

| (9) | Consists of (i) 88,028 shares of common stock and (ii) options to purchase 26,191 shares of common stock which are currently exercisable. |

| (10) | Consists of (i) 295,408 shares of common stock and (ii) options to purchase 14,286 that are either exercisable or will become exercisable within 60 days of July 6, 2022. |

| (11) | Consists of (i) 1,192,496 shares of common stock and (ii) options or warrants to purchase 291,543 shares of common stock that are either exercisable or will become exercisable within 60 days of July 6, 2022. |

| 14 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In addition to the compensation arrangements with our directors and executive officers, including those discussed in the sections titled “Management” and “Executive Compensation,” the following is a description of each transaction since January 1, 2019 and each currently proposed transaction in which:

| ● | we have been or are to be a participant; | |

| ● | the amount involved exceeded or exceeds the lesser of $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years (which was approximately $20,274); and | |

| ● | any of our directors, executive officers or holders of more than 5% of our outstanding capital stock, or any immediate family member of, or person sharing the household with, any of these individuals or entities, had or will have a direct or indirect material interest. |

On May 29, 2020 (the “Closing Date”), we entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) whereby we purchased all of the outstanding equity securities of Sport Defense LLC, a Delaware limited liability company (“Sports Defense”), from the members of Sport Defense (the “Sellers”). Subsequent to the Closing Date, Sport Defense is a wholly-owned subsidiary of the Company. Sport Defense is a marketing and distribution company that leverages the unique benefits of ultra-gentle, high-water content hydrogels, manufactured by the Company, to build brands that treat various ailments of the skin caused by athletic training, such as blisters, turf burns, scrapes and skin irritations.

Under the terms of the Purchase Agreement, the purchase price paid to the Sellers was an aggregate of $375 thousand (the “Purchase Price”) which was paid by the Company through the issuance of an aggregate of 267,858 shares of the Company’s common stock, par value $0.001 (the “Shares”), which equates to a per share purchase price of $1.40. The Shares are “restricted securities” as such term is defined by Rule 144 promulgated under the Securities Act of 1933, as amended.

Adam Levy, the Company’s Chief Executive Officer and Chief Financial Officer, and Nachum Stein, a member of the Company’s Board of Directors (the “Board”), were each members of Sport Defense and part of the Sellers. Mr. Levy received 44,197 of the Shares and Mr. Stein received 91,072 of the Shares. Due to the potential conflict of interest that existed because of Messrs. Levy and Stein’s partial ownership of Sport Defense, the Board obtained an independent investment bank to prepare a valuation report with respect to Sport Defense. This valuation report supported the Purchase Price. Also, Mr. Stein recused himself from the vote of the Board regarding the approval to purchase Sport Defense.

Related-Party Transaction Policy

Our audit committee charter that gives our audit committee the primary responsibility for reviewing and approving or disapproving “related-party transactions,” which are generally transactions between us and related persons in which the aggregate amount involved exceeds or may be expected to exceed $120,000 and in which a related person has or will have a direct or indirect material interest. The written charter of our audit committee provides that our audit committee shall review and approve in advance any related-party transaction.

In approving or rejecting any related party transactions, our audit committee considers the relevant facts and circumstances available and deemed relevant to our audit committee, including whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

Prior to the formation of our audit committee, our entire board of directors has been responsible for approving related-party transactions. The transactions described above were approved by our board of directors.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and officers, and persons who own more than ten percent of our common stock, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock. To our knowledge, based solely on a review of the copies of such reports furnished to us, during the fiscal year ended December 31, 2021, we believe that all filing requirements applicable to our officers, directors and greater than ten percent stockholders were complied with for the fiscal year ended December 31, 2021

Compensation Philosophy and Practices

We believe that the performance of our executive officers significantly impacts our ability to achieve our corporate goals. We, therefore, place considerable importance on the design and administration of our executive officer compensation program. This program is intended to enhance stockholder value by attracting, motivating and retaining qualified individuals to perform at the highest levels and to contribute to our growth and success. Our executive officer compensation program is designed to provide compensation opportunities that are tied to individual and corporate performance.

| 15 |

Our compensation packages are also designed to be competitive in our industry. The Compensation Committee from time-to-time consults with other advisors in designing our compensation program, including in evaluating the competitiveness of individual compensation packages and in relation to our corporate goals.

Our overall compensation philosophy has been to pay our executive officers an annual base salary and to provide opportunities, through cash and equity incentives, to provide higher compensation if certain key performance goals are satisfied.

The main principles of our fiscal year 2021 compensation strategy included the following:

| ● | An emphasis on pay for performance. A significant portion of our executive officers’ total compensation is variable and at risk and tied directly to measurable performance, which aligns the interests of our executives with those of our stockholders; | |

| ● | Equity as a key component to align the interests of our executives with those of our stockholders. Our Compensation Committee continues to believe that keeping executives interests aligned with those of our stockholders is critical to driving toward achievement of long-term goals of both our stockholders and the Company. |

The following table sets forth the names, ages and positions of our executive officers and certain significant employees as of , December 31, 2021 and currently:

| Name | Age | Position | ||

| Adam Levy | 59 | Chief Executive Officer, President and Director | ||

| Adam E. Drapczuk III | 46 | Chief Financial Officer |

Executive Officers

Adam Levy, Chief Executive Officer, President and Director

Mr. Levy has served as our Chief Executive Officer and President since September 10, 2019 and was our Chief Financial Officer from December 31, 2019 until June 1, 2021. Mr. Levy has also served on our Board since September 9, 2021. Mr. Levy is an investment banker associated with Cova Capital and has been a capital markets specialist for the past six years. Prior to that, he was the president and CEO of Warlock Records Inc. and its related companies from its inception in 1985. While at Warlock, he led the successful turn-around of several financially distressed music companies as part of a roll up strategy. He has expertise in consumer products, marketing, television/radio advertising and direct to consumer sales.

Adam E. Drapczuk, Chief Financial Officer

Mr. Drapczuk has served as our Chief Financial Officer since June 1, 2021. Mr. Drapczuk served as Financial Controller for R-Pharm US, a private fully integrated specialty pharmaceutical company focused on commercial opportunities to treat cancer and chronic immune diseases from September 2016 to April 2020 and has remained in a consulting role with the company since then. He also served as Vice President of Finance, CFO, for Inpellis, Inc.; Controller and Director of Finance for Tris Pharma; and Director of Finance for West-Ward Pharmaceuticals Corp. Mr. Drapczuk began his career in accounting and finance at KPMG LLP, servicing the firm’s assurance clients. He received his B.S. in accounting at Susquehanna University in Selinsgrove, PA.

The following table summarizes all compensation received by our named executive officer December 31, 2021 and 2020:

| Name and principal position | Year | Salary

($) | Bonus

($) | Stock

Awards ($) | Option

Awards ($) | Nonequity

Incentive Plan Compensation ($) | Change

in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All

Other Compensation ($) | Total

($) | |||||||||||||||||||||||||||

| Adam Levy, Chief Executive Officer (1) | 2021 | 180,000 | 50,000 | - | 72,961 | (2) | - | - | - | 302,961 | ||||||||||||||||||||||||||

| 2020 | 143,077 | - | 83,000 | - | - | - | - | 226,077 | ||||||||||||||||||||||||||||

| Adam E. Drapczuk III, Chief Financial Officer (3) | 2021 | 36,332 | - | - | - | - | - | - | 36,332 | |||||||||||||||||||||||||||

| 2020 | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||

| (1) | Mr. Levy was appointed as our Chief Executive Officer and President on September 10, 2019 and our Chief Financial Officer on December 31, 2019. On June 1, 2021, Adam E. Drapczuk was appointed to replace Mr. Levy as our Chief Financial Officer. | |

| (2) | On September 9, 2021, the Company granted a stock option of 14,286 shares of the Company’s common stock at a per share exercise price of $5.25 under the Company’s 2019 Long-Term Incentive Plan to Mr. Levy for his service as a board of director. The shares vest equally over four quarters, from October 1, 2021 through July 1, 2022. | |

| (3) | Mr. Drapczuk was appointed our Chief Financial Officer on June 1, 2021. Mr. Drapczuk does not currently have an employment agreement with the Company. |

| 16 |

Employment Agreements

Prior to November 4, 2021, Mr. Levy, our Chief Executive Officer, did not have an employment agreement with us. However, on November 4, 2021, we entered into an executive employment agreement with Mr. Levy which became effective upon our common stock being initially listed for trading on any tier of the NASDAQ Capital Market on December 27, 2021 (the “Initial Public Offering”). The term of the agreement is for one year from the Initial Public Offering.

Pursuant to the agreement, Mr. Levy is paid a base salary of $300,000 per year. Additionally, Mr. Levy is eligible for cash bonuses as follows: (i) $33,000 in the event the we achieve net income for two consecutive fiscal calendar quarters for the period which is one year after the Initial Public Offering (the “Net Income Bonus”) and (ii) $67,000 in the event the average closing price of our common stock over any consecutive three month period during the first year subsequent to the Initial Public Offering equals or exceeds one hundred and fifty percent (150%) the price per share at which our common stock is sold at the Initial Public Offering (the “Trading Price Bonus”). Both the Net Income Bonus and the Trading Price Bonus may be earned if both thresholds are achieved or either the Net Income Bonus or the Trading Price Bonus may be earned if only one of the thresholds is achieved. The Net Income Bonus and the Trading Price Bonus survive the termination of Mr. Levy so long as the termination is not for cause (as defined in the agreement) and the applicable thresholds are achieved within the one year period after the Initial Public Offering.

Mr. Levy is also entitled receive a grant of shares of our common stock equal to $50,000 divided by the per share price at which our common stock is sold at the Initial Public Offering (the “Equity Grant”). The Equity Grant vests in twelve equal monthly installments (subject to any rounding adjustments) during the term of the agreement with the first installment vesting on the effective date. Mr. Levy is also eligible to receive, from time to time, additional equity awards under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, and the terms and conditions of such awards, if any, would be determined by our Board of Directors or Compensation Committee, in their discretion. Mr. Levy is eligible to participate in any benefit plan or program we adopt.